Closing day is the final step in your home-buying journey. It marks the end for negotiations and the completion of inspections. Most importantly, you will become the owner of your brand new home.

It can be both exciting and nerve-wracking for buyers to close a deal. Closing involves not only a lot paperwork but also the final execution of all agreements made between the buyer and seller for the purchase of the property and the financing.

Your obligations on closing day

On the day of closing, you will have to review and then sign a number of legal documents which detail the conditions of the home sale. You will find that most of these documents relate to your loan, but you must also be aware of other important details before you sign.

After you have signed the closing papers, what happens?

After you have signed the closing documents the lender will record a legal document known as a title or "deed". This is the document that transfers the ownership of the house to you. It can take some time, but is worth it in order to confirm that you are the owner of the property and that there are no liens against it.

You'll also be required to sign the mortgage form, which details the amount you owe, the rate of interest you pay, and other important information regarding the home loan. This document, which highlights your rights as a borrowers, is crucial to the closing.

Signing a mortgage is an agreement to pay the entire loan and all required payments in full. In case of default, you may lose your house.

Your financial situation may have changed since you submitted your application for a mortgage. Therefore, your lender wants to verify that you still meet the requirements for the loan. The lender provides you with a "closing declaration" or "mortgage disclosure" for you to review and then sign. You should ask your mortgage broker or realtor if there are any questions regarding your financial situation.

Your lender may also ask you to sign documents related to your mortgage. These may include an affidavit of truth or a statement that you have made all necessary repairs before closing.

Depending on what home you're buying, you may be required to sign a variety of closing documents. For example, some lenders require you to sign a "mortgage affidavit" that states you have received an appraisal of the home and that you are not in default of any previous mortgages on the same property.

Affidavits form an important part of the home purchase process. They confirm that all information provided by you is true and accurate. The affidavit confirms that you made all the necessary repairs before closing the sale and that the property is in good working order and can be sold for the full price.

FAQ

Is it better buy or rent?

Renting is generally cheaper than buying a home. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. You also have the advantage of owning a home. For example, you have more control over how your life is run.

How can I get rid Termites & Other Pests?

Your home will eventually be destroyed by termites or other pests. They can cause serious damage and destruction to wood structures, like furniture or decks. It is important to have your home inspected by a professional pest control firm to prevent this.

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types: conventional and government-insured (FHA). Conventional reverse mortgages require you to repay the loan amount plus an origination charge. If you choose FHA insurance, the repayment is covered by the federal government.

What are the most important aspects of buying a house?

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location is the location you choose to live. Price is the price you're willing pay for the property. Size refers how much space you require.

How do I know if my house is worth selling?

Your home may not be priced correctly if your asking price is too low. A home that is priced well below its market value may not attract enough buyers. You can use our free Home Value Report to learn more about the current market conditions.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

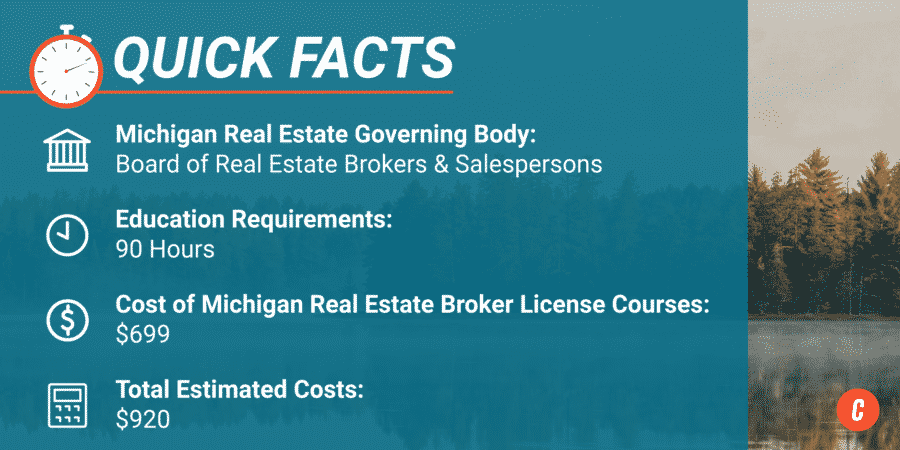

How to become a broker of real estate

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires that you study for at most 2 hours per days over 3 months.

Once you have passed the initial exam, you will be ready for the final. In order to become a real estate agent, your score must be at least 80%.

All these exams must be passed before you can become a licensed real estate agent.