Real estate referral fees are an important way for real estate agents to generate income. Real estate agents can also take on different clients who may be looking to buy a house or property in a desirable location. It can be an excellent source of income, but the agent must know the rules and negotiate the fee.

Referrals are a fantastic way for agents of real estate to generate income, but the fees must be negotiated with care. Referral fees usually represent a percentage of an agent's commission, which is paid when the agent refers a client to sell or buy a home. The percentage can be anywhere between 1-2%.

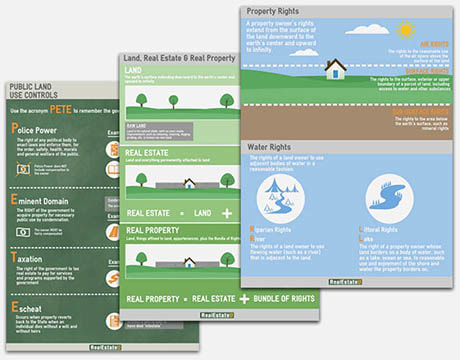

What is the referral fee for real estate?

A finder’s or referral fee is paid to a third party who facilitates the leasing, selling, or purchasing of real property. It is possible that a broker can receive more than 3% based on state or federal laws.

How legal is a fee for referrals?

In many states, there are strict laws that govern how referrals can be paid. This is particularly true when it comes to agent-to-agent referals. This law states that a referral can only paid to licensed professionals.

There are exceptions to the rule. These exceptions may not make the referring agents legally responsible for the result of the transaction. In some cases, this can create a problem.

What is a Real Estate Agent Referral Fee?

The answer to this depends on your broker. State-by-state, most brokerages use a standard referral percentage. The fee can be as high at 25% of gross commissions for the agent referred.

How is a real estate agent referral fee regulated?

In most states, a referral fee can only be paid to a real estate agent who is licensed. This is particularly important when broker-to-broker referals are involved, as the referring real estate agent must be licensed in order for the broker to pay a referral fee.

This means that a broker with a solid track record can refer a seller to another agent in an area where they may not know the market. It is a very simple and effective process that can generate income for both brokers.

How does an investor pay a realtor's finder fee?

If an investment wants to pay their friend a finding fee, the investor should contact the licensing authorities of the state or federal government to verify that the individual requesting the payment is a licensed facilitator. It is illegal to pay finders' fees if they do not have a license.

How can an investor convince a real-estate broker to recommend them?

Most real estate agents will accept a referral payment if the amount is reasonable and customary. This can be a great way to increase your income and build your business, but it's important that you do not exceed the legal limit. Moreover, to avoid any problems you should follow the legal requirements in your state and the rules set by your brokerage.

FAQ

How long does it take to get a mortgage approved?

It depends on several factors including credit score, income and type of loan. It usually takes between 30 and 60 days to get approved for a mortgage.

What can I do to fix my roof?

Roofs can burst due to weather, age, wear and neglect. For minor repairs and replacements, roofing contractors are available. Contact us for further information.

How much money will I get for my home?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Can I afford a downpayment to buy a house?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include government-backed mortgages (FHA), VA loans and USDA loans. Check out our website for additional information.

How much money should I save before buying a house?

It depends on how long you plan to live there. It is important to start saving as soon as you can if you intend to stay there for more than five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

Should I use a mortgage broker?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers do take a commission from lenders. Before signing up for any broker, it is important to verify the fees.

What are the cons of a fixed-rate mortgage

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to buy a mobile house

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. People who want to live outside of the city are now using mobile homes. These houses are available in many sizes. Some houses are small, others can accommodate multiple families. Some are made for pets only!

There are two types main mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This is done before the product is delivered to the customer. A second option is to build your own mobile house. Decide the size and features you require. Next, make sure you have all the necessary materials to build your home. Finally, you'll need to get permits to build your new home.

These are the three main things you need to consider when buying a mobile-home. A larger model with more floor space is better for those who don't have garage access. You might also consider a larger living space if your intention is to move right away. Third, make sure to inspect the trailer. You could have problems down the road if you damage any parts of the frame.

You should determine how much money you are willing to spend before you buy a mobile home. It is important to compare the prices of different models and manufacturers. You should also consider the condition of the trailers. Many dealers offer financing options. However, interest rates vary greatly depending upon the lender.

An alternative to buying a mobile residence is renting one. You can test drive a particular model by renting it instead of buying one. Renting isn't cheap. Renters generally pay $300 per calendar month.