Real estate commission pa, which is a fee paid by home sellers to their agent for their help in selling their property, is called a real estate brokerage fee. Pennsylvania's average real estate commission is 5.53% of the property's sale price. However, this fee can vary depending upon the size of the property and how many transactions the agent has completed in a given year.

How Much Does a Realtor Make in Pennsylvania?

Agents make a commission by representing buyers and sellers of property. The commission is usually based on the sale price of the property or house. The commission is paid by the landlord in New York City. In other areas of the country, the commission is paid by the buyer.

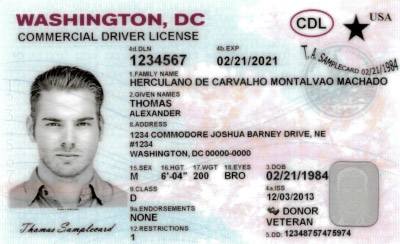

Pennsylvania Licenses

The 75-hour Prelicensing Course is required in order to become a Pennsylvania licensed realty agent. There are many options for this course, including online courses and live, in-person classes. The course is divided into two sections: 30 hours of foundations and 45 hours for a practice exam.

Requirements to renew your Pennsylvania real estate license

To renew your Pennsylvania realty license, you must successfully complete a state-approved continuing education course in property sales. The Department of Consumer Protection must approve this course.

The Pennsylvania Real Estate Commission regulates salespeople and real estate brokers. It also regulates activities that involve cemeteries, cemetery businesses, promotional property, and campground memberships.

How can I obtain a Pennsylvania real estate license?

It is very easy to obtain a Pennsylvania license. Nearly all potential real estate agents must complete a 75 hour prelicensing course and pass a real license exam before applying to be licensed. This exam is multiple-choice and is designed to test the applicant's knowledge about the laws that govern real estate sales.

How can I negotiate lower commission rates?

If you have hired a realty agent to help sell your home, they will give you an estimate for their commission. A seller may pay more than they are actually entitled to, so it is always worth asking for a lower fee.

If your Pennsylvania home is for sale, you may want to list it with a dual agency. This means you will work with two agents simultaneously, one representing the seller and one representing buyers. It can be a great way to save money and ensure that both parties are being taken care of.

In such cases, the broker representing the buyer will split any commissions with his or her cooperating brokers. This will be discussed and agreed upon in the purchase agreement.

A seller's broker will normally negotiate a commission together with the buyer's to get the best possible price for their house. It is important to understand the current market conditions in your local area before you decide to sell. You can check out the trends in the real estate market for your area if you aren't sure.

FAQ

Can I afford a downpayment to buy a house?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include government-backed mortgages (FHA), VA loans and USDA loans. More information is available on our website.

Do I need to rent or buy a condo?

Renting might be an option if your condo is only for a brief period. Renting will allow you to avoid the monthly maintenance fees and other charges. A condo purchase gives you full ownership of the unit. You can use the space as you see fit.

What should you consider when investing in real estate?

You must first ensure you have enough funds to invest in property. You will need to borrow money from a bank if you don’t have enough cash. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You must also be clear about how much you have to spend on your investment property each monthly. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

You must also ensure that your investment property is secure. It would be best if you lived elsewhere while looking at properties.

What is the average time it takes to get a mortgage approval?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

Is it better buy or rent?

Renting is generally less expensive than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. You also have the advantage of owning a home. For example, you have more control over how your life is run.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to Find Houses to Rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. It may take time to find the right house. When it comes to choosing a property, there are many factors you should consider. These factors include price, location, size, number, amenities, and so forth.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. For recommendations, you can also ask family members, landlords and real estate agents as well as property managers. This will give you a lot of options.