To build a successful Virginia real estate career, you must first obtain a broker's license. To become a licensed broker, you need to pass the state licensing examination and complete 180 education hours. You must hold a Virginia license as a salesperson at least for 3 years before you can apply for a Virginia brokerage license.

How to Become a Real Estate Broker in Virginia

The process of obtaining a Virginia real-estate broker's license is relatively straightforward. You can submit your application for processing to DPOR after you have passed the required courses and examinations. It can take anywhere from three to six months, depending upon how quickly you complete your pre-licensing course work and the amount of time required to study for the examination.

How to pass the VA Real Estate Broker Exam

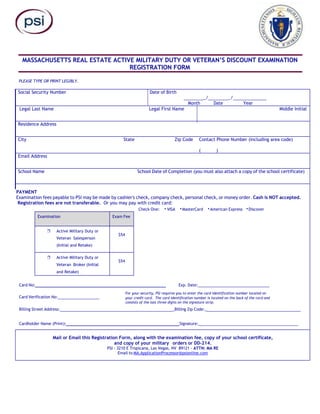

The real estate broker license in Virginia is administered by PSI. Find out more here about the PSI Broker Exam and how to register. The national and state portions of the exam must be passed.

How to Apply for a Virginia Real estate Broker License

You must be 18 years of age and hold a GED or high school diploma to obtain a Virginia broker's license. You must also have been actively involved in real estate (average of 40 hours per week for 36 months) before you submit your application.

How to become a broker in virginia

Before you can begin the Virginia Real Estate Broker License process, it is necessary to take a VA Real Estate Board-approved real estate course. This course should take at least 60 hours and you can spread it out over a few weeks to make sure that you are prepared.

This course can be taken in a classroom or online. If you decide to take the course at a school, ensure that they are licensed by the VA Real Estate Board.

How to start an estate agency in Virginia

Finding a sponsoring broker that will act as your mentor is the first part of becoming a Virginia Broker. This person will assist you in obtaining your license. They can answer your questions regarding the industry, and they will provide you with guidance and support throughout your career.

How to find an agent sponsor

For a Virginia realty brokerage, look for one that has at least two-years of experience on the local market. You should ask them about their experience, reputation and the training they provide for their agents.

How to choose the right broker

If you want to find a broker who is reputable, then ask him about his experience in the business and the kinds of clients he works with. Ask them about their previous history with VA Real Estate Board.

When choosing a Virginia broker, ensure they are experienced in the market you work in, that they know Virginia laws and regulations and that their reputation is one of integrity and honest.

FAQ

What is a Reverse Mortgage?

A reverse mortgage lets you borrow money directly from your home. It works by allowing you to draw down funds from your home equity while still living there. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance will cover the repayment.

What should you look for in an agent who is a mortgage lender?

Mortgage brokers help people who may not be eligible for traditional mortgages. They work with a variety of lenders to find the best deal. This service may be charged by some brokers. Others offer no cost services.

Do I need flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more information about flood insurance.

What are the 3 most important considerations when buying a property?

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location is the location you choose to live. Price is the price you're willing pay for the property. Size refers how much space you require.

How many times do I have to refinance my loan?

This is dependent on whether the mortgage broker or another lender you use to refinance. Refinances are usually allowed once every five years in both cases.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. To become a realty agent, you must score at minimum 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!