You should consider a variety of factors when you decide if becoming a real-estate broker is the right career choice. These can include everything from getting your license to working with clients and other professionals in real estate. It will be easier to begin earning money the more you know.

Getting a real estate license

A real estate licence may be the best choice for someone who wants a flexible career, but needs a lot to know. You can earn a substantial income by becoming a real-estate broker, unlike other jobs that require years and experience. A key ingredient to being a successful realty broker is being self-motivated, having strong community connections, and being willingly to work hard. Although the potential earning potential is enormous, it's important to recognize that there will be competition.

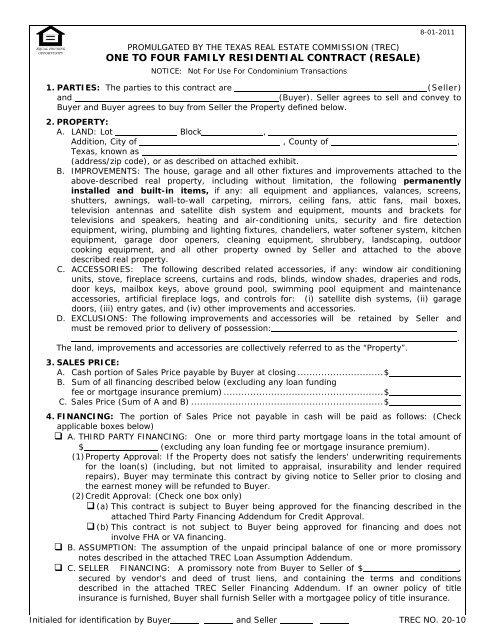

In order to become a licensed real estate agent, you need to pass a test. It's not an easy test, and many people fail it their first attempt. In fact, some people never even pass it. To pass the exam, you will need to score at least 70 percent. In order to pass the exam, you must have answered at most 53 questions.

Finding clients through a broker in real estate

If you want to get more clients from your real estate brokerage, you should get online and create a presence on social media. Event hosting can help you build relationships and provide information. You can even host social events where you can meet potential clients.

To get clients for your brokerage, the first step is to create a compelling site. Your free services should be promoted. You can offer free photography or a market analysis. These services are not required, but they can save you clients hundreds of thousands.

Real estate brokers can make a living.

You can make a good living as a real estate broker. This is a great opportunity to share your expertise and knowledge about the local housing market with others. Flexible hours are possible, and you may work weekends and evenings. Before you start your career, make sure to research licensing requirements and do your homework. You might have to pass a background check, fingerprinting or an exam in order to become a real-estate agent.

The potential for high-paying real-estate brokerage work can be quite lucrative. A real-estate agent in Austin can make up to $88,996 per year, which is 13% more than the national average. This city, which is growing rapidly because of its booming tech scene, has nearly one million people. This is great news if you are an agent looking to work for a city that has a growing population. Depending on the location and average sales price, an average real estate agent commission can range from three to seven per cent.

Collaboration with other professionals in real estate

A real estate broker involves working with people from all walks. Some clients are difficult, while others may be stressed sellers or agents who are competitive. This field requires you to work long hours, sometimes even on weekends. High stress work can make it difficult. You might also have to manage many properties and deal effectively with uncertainty.

Real estate brokers will have to interact with other professionals in the industry and be able to keep up with market changes. You'll also need to develop discipline in order to follow through on tasks. For success, setting daily goals is essential. It's also important to plan your work weeks in advance. It's crucial to allocate time for networking and professional learning.

Stress at work

Many real-estate agents deal with a lot of stress. Not only do they deal with angry home sellers and needy buyers, but they also have to deal with strict mortgage lenders and uptight home inspectors. This can lead to high levels of stress that can have a negative impact on your physical health.

Stress can be overwhelming but some people thrive in it. There are ways you can balance the demands of work and your personal life. Some stress management tips can help you manage real estate pressures.

FAQ

What are the chances of me getting a second mortgage.

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

How much money do I need to save before buying a home?

It all depends on how many years you plan to remain there. You should start saving now if you plan to stay at least five years. But if you are planning to move after just two years, then you don't have to worry too much about it.

How can you tell if your house is worth selling?

Your home may not be priced correctly if your asking price is too low. A home that is priced well below its market value may not attract enough buyers. You can use our free Home Value Report to learn more about the current market conditions.

How do I eliminate termites and other pests?

Termites and many other pests can cause serious damage to your home. They can cause serious damage to wood structures like decks or furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

How much money will I get for my home?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to buy a mobile home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. Today, mobile homes are also used by people who want to live out of town. Mobile homes come in many styles and sizes. Some houses are small, others can accommodate multiple families. Even some are small enough to be used for pets!

There are two types of mobile homes. The first type is produced in factories and assembled by workers piece by piece. This happens before the product can be delivered to the customer. Another option is to build your own mobile home yourself. Decide the size and features you require. Next, ensure you have all necessary materials to build the house. To build your new home, you will need permits.

You should consider these three points when you are looking for a mobile residence. You may prefer a larger floor space as you won't always have access garage. A model with more living space might be a better choice if you intend to move into your new home right away. You'll also want to inspect the trailer. If any part of the frame is damaged, it could cause problems later.

Before buying a mobile home, you should know how much you can spend. It's important to compare prices among various manufacturers and models. You should also consider the condition of the trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

Instead of purchasing a mobile home, you can rent one. Renting allows you the opportunity to test drive a model before making a purchase. Renting is expensive. Most renters pay around $300 per month.