You can obtain a Minnesota real estate license if you meet certain requirements. Minnesota Commerce Department is committed to ensuring that real estate agents can work in the state. These requirements include being at minimum 18 years of age and U.S. citizens, or legal aliens. Although most users are not concerned about citizenship, you could be denied a license in the event of any criminal history or unpaid judgments. A real estate license should not be denied if you are involved in unlicensed real-estate activity.

Pre-license education

Pre-license education is a crucial part of becoming licensed in Minnesota as a real estate agent. It can help increase your chances of passing the exam and avoiding retaking it. Minnesota requires you to be licensed as a real agent within four months. The licensing process depends on completing the pre-license education course, passing the exam and being sponsored by a licensed brokerage.

Online pre-license courses are a great way to get your Minnesota real estate license. Three courses lasting 30 hours can be completed to help you obtain your license. These courses cover topics such as real estate principles, valuation, contracts, financing, and more. The course can also be completed online via ContinuingEd Express. They offer live streaming and online courses.

You must continue your education

Minnesota real estate salespeople must complete at most fifteen hours of continuing training each year. This equates to 30 hours total over a 2-year renewal period. There are several ways to earn the required real-estate CE. These include online classes, webinars on demand, and live courses. Kaplan provides both live and on-demand classes to fulfill the state's continuing educational requirements. Kaplan's online courses have been approved for 3.75 hour real estate CE.

Minnesota Real Estate Commission adopted a new system of real estate CE credit. This means that real estate licensees must complete at least eight hours of continuing education in a single day, but no more than 15 hours in a 24-hour period. Minnesota's continuing-education requirements for brokers and salespeople require that they complete a prelicensing CE module. These courses can be used to earn 3.75 hours CE credit. They must be completed before June 30, 20,22. You can also take the course online, even if you don't have a live instructor. While most courses can be completed on your own, some are streamed live. Exam prep courses include both the national exam and the state portion of the Minnesota licensing exam.

Exam

Minnesota requires that you pass an exam to obtain a license to sell real estate. This examination helps protect the public and ensures that an individual is competent. The state regulatory agency establishes a standard for safe practices. The exam is designed to confirm that an individual has met those standards. The Minnesota real estate licensing examination is administered by Pearson VUE.

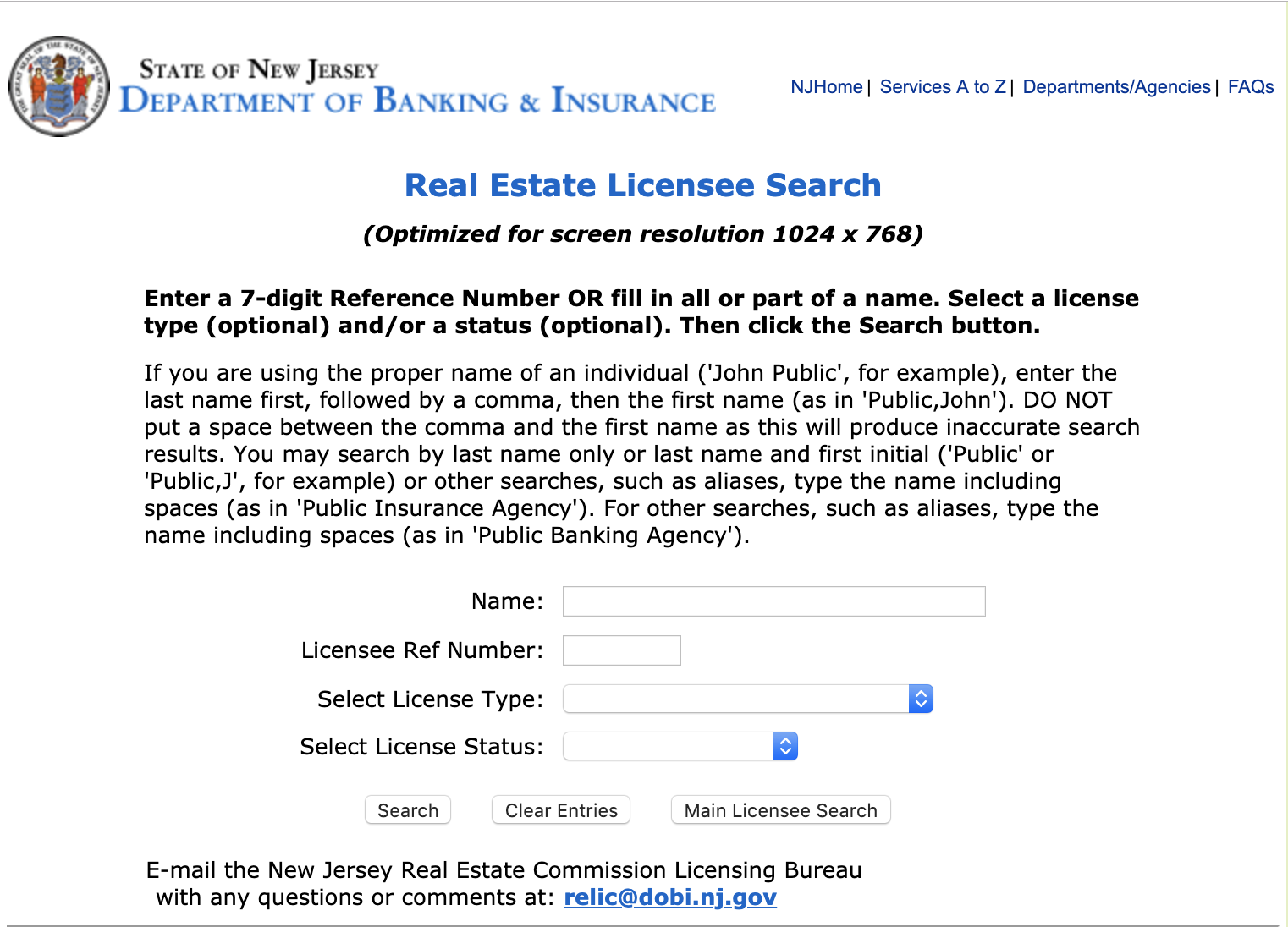

Minnesota real estate license applicants must have passed a prelicense education course and a state exam to be eligible for it. The state requires that applicants are at least 18 years of age and a legal permanent resident of the United States. Minnesota has reciprocity agreement with several states, including Wisconsin. Minnesota has reciprocity agreements with several other states. You do not need to take any prelicensing courses if you're a licensed agent in one of these states. The PULSE Portal allows you to apply online and send a letter attesting to your current license. You will also be able pass the state section of the exam. In Wisconsin, however, you must take a 13-hour Wisconsin-to-Minneseta prelicensing course.

Prices

To become a Minnesota real estate agent, the first step is to get a license. You can complete the entire process online with the exception that you must take the exam in person. This article will give you the details of the process, including the cost and time it will take. We will also cover the exam content, and give you some resources for additional information.

The state of Minnesota requires that all real estate agents complete at least 90 hours of pre-licensing education. These can be done online or through classes. Online on-demand courses are the most affordable. A package that includes three courses typically costs $200 to $300.

FAQ

What flood insurance do I need?

Flood Insurance protects you from flooding damage. Flood insurance protects your possessions and your mortgage payments. Find out more about flood insurance.

How can I fix my roof

Roofs can leak due to age, wear, improper maintenance, or weather issues. Minor repairs and replacements can be done by roofing contractors. Contact us for more information.

Can I purchase a house with no down payment?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. You can find more information on our website.

What's the time frame to get a loan approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This will ensure that there are no rising interest rates. Fixed-rate loans also come with lower payments because they're locked in for a set term.

How do I calculate my interest rates?

Market conditions influence the market and interest rates can change daily. The average interest rate during the last week was 4.39%. Add the number of years that you plan to finance to get your interest rates. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires that you study for at most 2 hours per days over 3 months.

Once this is complete, you are ready to take the final exam. To become a realty agent, you must score at minimum 80%.

Once you have passed these tests, you are qualified to become a real estate agent.